Triclosan

Content Navigation

CAS Number

Product Name

IUPAC Name

Molecular Formula

Molecular Weight

InChI

InChI Key

SMILES

solubility

Slightly soluble in water

Readily soluble in alkaline solutions and many organic solvents; soluble in methanol, alcohol, acetone

Readily soluble in organic solvents

Synonyms

Canonical SMILES

Antimicrobial Activity

- Antibacterial and Antifungal Effects: Triclosan exhibits broad-spectrum antimicrobial activity against bacteria, including Gram-positive and some Gram-negative species, as well as some fungi []. Studies have documented its effectiveness in reducing bacterial biofilms, which are communities of microorganisms that can adhere to surfaces and become resistant to traditional treatments.

Potential Health Concerns

- Endocrine Disruption: Research suggests triclosan might act as an endocrine disruptor, interfering with hormone signaling in the body. Studies have shown that triclosan can disrupt thyroid hormone function in animals.

- Antibiotic Resistance: Concerns exist that triclosan's widespread use could contribute to the development of antibiotic resistance in bacteria. Some studies have shown triclosan can select for resistant bacterial strains, although the significance of this finding in real-world settings remains under investigation.

Environmental Impact

- Persistence and Transformation: Triclosan is persistent in the environment, meaning it degrades slowly. Research has shown triclosan can be transformed into other chemicals by environmental processes, raising concerns about potential ecological effects.

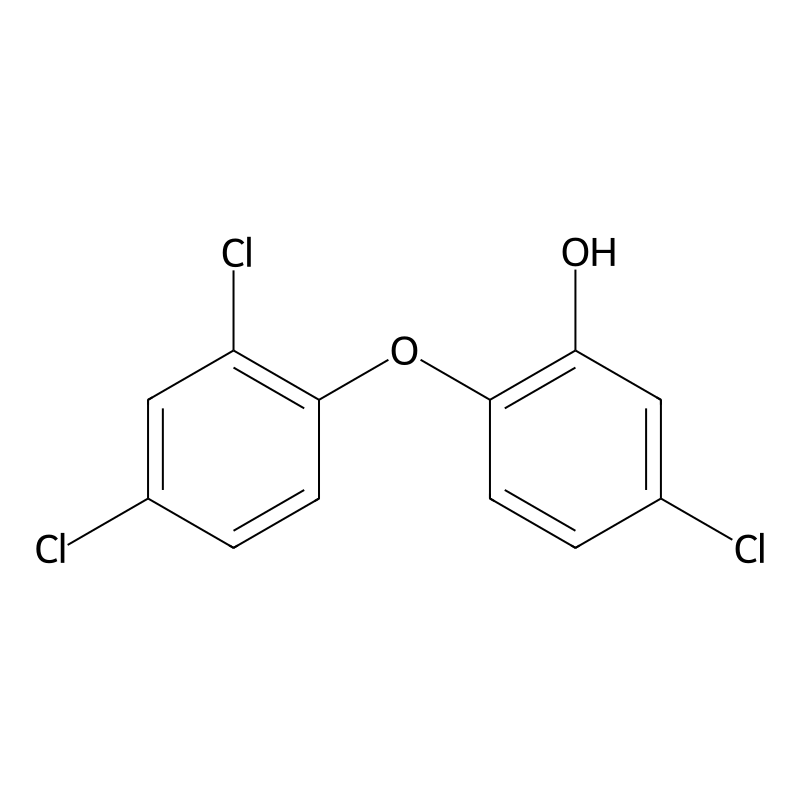

Triclosan is a synthetic antimicrobial compound, specifically classified as a chlorinated phenolic agent. Its chemical structure is represented as 5-chloro-2-(2,4-dichlorophenoxy)phenol, with the molecular formula . First developed in the 1960s as a pesticide, it has since found extensive use in various consumer and industrial products due to its antibacterial properties. Triclosan is weakly soluble in water but dissolves well in organic solvents like ethanol and dimethyl sulfoxide .

Triclosan primarily acts by inhibiting fatty acid synthesis in bacteria. It binds to the enoyl-acyl carrier protein reductase enzyme (ENR), which is essential for the fatty acid elongation cycle. This binding leads to the formation of a ternary complex that prevents the enzyme from participating in fatty acid synthesis, ultimately compromising bacterial cell membranes and causing cell death . The compound can also undergo various

The synthesis of triclosan typically involves chlorination of phenolic compounds. A common method includes the reaction of 2,4-dichlorophenol with sodium hydroxide and 5-chloro-2-hydroxybenzaldehyde under controlled conditions. This process results in the formation of triclosan through nucleophilic substitution reactions that introduce chlorine atoms into the aromatic ring structure .

Triclosan has been widely used in various applications, including:

- Consumer Products: Incorporated into antibacterial soaps, toothpaste, deodorants, and cosmetics.

- Industrial Uses: Added to textiles, plastics, and coatings to provide antimicrobial properties.

- Healthcare: Used in surgical scrubs and disinfectants to reduce bacterial contamination .

Despite its widespread use, regulatory scrutiny has increased due to safety concerns.

Research indicates that triclosan can interact with various biological systems. For instance, it may bind to proteins involved in fatty acid metabolism and disrupt normal cellular functions. Additionally, studies have shown that triclosan exposure can lead to increased resistance among certain bacterial strains by upregulating efflux pumps that expel the compound from bacterial cells . Furthermore, animal studies suggest potential immunological impacts, such as heightened allergic responses following triclosan exposure .

Triclosan shares structural and functional similarities with several other antimicrobial agents. Below is a comparison highlighting its uniqueness:

| Compound Name | Chemical Structure | Unique Features |

|---|---|---|

| Chlorhexidine | C22H30Cl2N10 | Broad-spectrum antiseptic; used mainly in healthcare settings. |

| Benzalkonium chloride | C22H38NCl | Quaternary ammonium compound; effective against bacteria and viruses but less effective against spores. |

| Hexachlorophene | C12H6Cl6 | Strong antibacterial properties; used primarily in hospital settings but restricted due to safety concerns. |

| Triclocarban | C13H9Cl3O | Similar antibacterial properties; often found in soaps but less effective than triclosan against certain pathogens. |

Triclosan is distinct due to its specific mechanism targeting fatty acid synthesis pathways in bacteria while also being an endocrine disruptor—a characteristic not shared by all similar compounds .

Historical Synthetic Pathways

The earliest commercial synthesis of triclosan emerged in the late 1960s through the work of Ciba-Geigy Corporation, which developed the compound as part of their antimicrobial research program [2]. The historical approach to triclosan synthesis involved a multi-step process beginning with the demethylation of 2,4,4'-trichloro-2'-methoxydiphenyl ether using aluminum chloride as a Lewis acid catalyst [3] [4]. This classical method represented the foundation for large-scale production and established the basic chemical framework for subsequent manufacturing improvements.

The original Ciba-Geigy process utilized aluminum chloride in benzene under reflux conditions to achieve the demethylation reaction [4]. This method, while effective, required careful control of reaction conditions to minimize the formation of unwanted byproducts, particularly chlorinated dibenzo-p-dioxins and dibenzofurans, which could arise under extreme alkaline and high-temperature conditions [4] [5]. The historical significance of this pathway lies in its establishment of triclosan as a commercially viable antimicrobial agent, leading to widespread adoption across multiple industries.

Alternative historical approaches included variations in the starting materials and reaction conditions. Some manufacturers experimented with different solvents and catalyst systems to optimize yield and purity while reducing the formation of problematic impurities [5]. The evolution of these early synthetic methods laid the groundwork for the more sophisticated manufacturing protocols that would emerge in subsequent decades.

Modern Manufacturing Protocols (Condensation-Reduction-Diazotization)

Contemporary triclosan manufacturing has evolved to incorporate more sophisticated synthetic protocols, with the condensation-reduction-diazotization sequence representing the most advanced and widely adopted industrial approach [6] [7]. This modern methodology begins with a condensation reaction between 2,5-dichloro-nitrobenzene and 2,4-dichloro-phenol under alkaline conditions, producing 2,4,4'-trichloro-2'-nitro-diphenyl ether as the initial intermediate [6].

The second stage involves hydrogenating reduction using nickel catalysis to convert the nitro group to an amino group, yielding 2,4,4'-trichloro-2'-amino-diphenyl ether [6]. This reduction step requires precise control of temperature and pressure conditions, typically conducted at 160-170°C with careful monitoring of reaction progress [6]. The use of nickel catalysts has proven particularly effective in achieving high conversion rates while maintaining selectivity for the desired product.

The diazotization step represents the most critical phase of the modern synthesis, involving the treatment of the amino intermediate with sulfuric acid and sodium nitrite to form the corresponding diazonium salt [6] [8]. This reaction requires strict temperature control, typically maintained at 0-5°C during the initial stages to prevent decomposition of the diazonium intermediate. The spectrophotometric optimization of this diazotization reaction has been extensively studied, with research indicating optimal conditions involving specific concentrations of hydrochloric acid, sodium nitrite, and aniline for maximum efficiency [8].

The final hydrolytic step employs sulfuric acid in the presence of a copper catalyst to convert the diazonium salt to the desired triclosan product [6]. Modern manufacturing facilities have incorporated advanced process control systems to monitor each stage of this synthesis, ensuring consistent product quality and minimizing the formation of impurities that could compromise the final product specifications.

Industrial-Grade vs. Pharmaceutical-Grade Purification

The distinction between industrial-grade and pharmaceutical-grade triclosan centers on purity specifications, regulatory compliance, and intended applications [9] [10] [11]. Industrial-grade triclosan typically maintains purity levels of 97-99%, which proves adequate for applications in textiles, plastics, coatings, and general antimicrobial treatments where absolute purity is not critical [12]. This grade focuses on cost-effectiveness while maintaining sufficient antimicrobial efficacy for industrial applications.

Pharmaceutical-grade triclosan, in contrast, must meet stringent United States Pharmacopeia standards, requiring purity levels of 99-103% on an anhydrous basis [9] [10] [11]. The USP grade specifications include comprehensive testing for water content (<0.1%), heavy metals (<10 parts per million), and specific impurity limits for various chlorinated compounds [11]. Critical impurity control includes monitoring for monochlorophenols (<50 parts per million), 2,4-dichlorophenol (<10 parts per million), and various dioxin and dibenzofuran compounds at parts per trillion levels [11].

The purification processes for pharmaceutical-grade triclosan involve multiple recrystallization steps, advanced chromatographic techniques, and rigorous analytical testing protocols [13]. Manufacturing facilities producing pharmaceutical-grade material must operate under current Good Manufacturing Practices as defined by 21 Code of Federal Regulations part 211, with FDA registration and regular inspections [9] [10]. The analytical methods employed include reversed-phase high-performance liquid chromatography with photodiode array detection at 281 nanometers, gas chromatography with flame ionization detection, and mass spectrometry for impurity identification [13] [14].

Quality control protocols for pharmaceutical-grade triclosan require validation of analytical methods with linearity ranges typically spanning 1-50 micrograms per milliliter, with correlation coefficients exceeding 0.997 [13]. Limit of detection and quantification values must be established at 0.101 and 0.333 micrograms per milliliter respectively, ensuring adequate sensitivity for impurity detection [13]. The robustness testing involves variations in analytical parameters such as wavelength (±5 nanometers) and flow rate (±10%) to demonstrate method reliability [13].

Global Market Trends and Key Manufacturers

The global triclosan market demonstrates significant regional variations and evolving dynamics influenced by regulatory changes, environmental concerns, and shifting consumer preferences. Market research indicates current valuations ranging from USD 79.7 million to USD 150 million in 2024, with projected growth to USD 94.1-250 million by 2030-2033, representing compound annual growth rates of 2.8-7.2% [15] [16] [17] [18] [19] [20].

| Market Research Source | Base Year Value (USD Million) | Projected Value (USD Million) | CAGR (%) |

|---|---|---|---|

| Allied Market Research (2021-2031) | 69.9 | 111.1 | 4.8 |

| Custom Market Insights (2021-2030) | 68.5 | 112.1 | 5.8 |

| Research and Markets (2024-2030) | 79.7 | 94.1 | 2.8 |

| Precision Business Insights (2024-2031) | 86.4 | 118.4 | 4.6 |

| 360iResearch (2024-2030) | 134.4 | 183.7 | 5.35 |

| Market Research Intellect (2024-2033) | 150.0 | 250.0 | 7.2 |

The manufacturing landscape has undergone substantial transformation, particularly following BASF SE's decision to discontinue triclosan production at its Grenzach facility in 2020 due to declining market demand [21]. This strategic withdrawal by one of the world's largest chemical manufacturers has created opportunities for other producers, particularly in Asia-Pacific regions where regulatory frameworks remain more accommodating [16] [17].

| Company | Region | Production Status | Market Focus |

|---|---|---|---|

| BASF SE | Germany/Global | Discontinued production in 2020 | Industrial applications |

| Kumar Organic Products Limited | India | Active manufacturer | Pharmaceutical/Industrial |

| Ciba Specialty Chemicals | Switzerland/Global | Acquired by BASF | Personal care/Industrial |

| Spectrum Chemical | USA | Distributor/Manufacturer | Laboratory/Pharmaceutical |

| Salicylates and Chemicals Pvt. Ltd. | India | Active manufacturer | Pharmaceutical/Industrial |

| Jiangsu Huanxin High-tech Materials Co. Ltd. | China | Active manufacturer | Industrial/Export |

Kumar Organic Products Limited has emerged as a significant player in the Indian market, offering pharmaceutical-grade triclosan under the brand name Kopsan with Drug Master File registration 168181 [22]. The company maintains Good Manufacturing Practices certification and United States Food and Drug Administration approval for its triclosan production [22]. Their specifications include 97-103% assay by gas chromatography, with impurity levels maintained below 0.5% and comprehensive quality control protocols [22].

The Chinese market has gained prominence through companies such as Jiangsu Huanxin High-tech Materials Co. Ltd., which focuses on industrial-grade applications and export markets [23] [24]. Chinese manufacturers have capitalized on cost advantages and growing domestic demand, particularly in textile and plastic applications where triclosan serves as an antimicrobial preservative [25].

Regional market dynamics reveal Europe as the largest current market, driven by established industrial applications and regulatory frameworks that continue to permit specific uses [16] [17]. The Asia-Pacific region demonstrates the fastest growth rates, attributed to expanding personal care markets, industrial development, and less restrictive regulatory environments [16] [17]. North American markets face continued regulatory challenges, with the Food and Drug Administration ban on consumer soap products limiting growth potential while maintaining opportunities in specialized applications [26].

The industrial-grade segment continues to dominate market share, accounting for approximately 85% of total triclosan consumption within the European Union [25]. This segment benefits from applications in commercial, institutional, and industrial equipment where triclosan serves as an antimicrobial preservative in conveyor belts, ice-making equipment, and heating, ventilation, and air conditioning systems [27] [25]. The material preservative applications in residential and public access premises, including shower curtains, flooring, and mattresses, contribute significantly to industrial-grade demand [12].

Pharmaceutical-grade triclosan maintains growth potential despite regulatory restrictions, particularly in dental care applications where alternative antimicrobial agents prove less effective or cost-prohibitive [28] [15]. The personal care and cosmetics segment, while facing regulatory challenges in developed markets, continues to drive demand in emerging economies where triclosan remains permitted in formulations at concentrations between 0.1-0.3% [26] [16].

The evolving regulatory landscape significantly influences market dynamics, with manufacturers increasingly focusing on research and development activities to identify alternative applications and improve existing formulations [16]. The transition toward sustainable manufacturing practices has become a key focus, with companies investing in cleaner production technologies and environmental impact mitigation strategies [20].

Manufacturing capacity adjustments reflect these market realities, with producers concentrating operations in regions with favorable regulatory environments while maintaining quality standards for export markets [18]. The consolidation of manufacturing among fewer, larger producers has led to increased emphasis on vertical integration and supply chain optimization to maintain competitiveness in a challenging regulatory environment [20].

Triclosan undergoes extensive microbial transformation in environmental systems through diverse metabolic pathways that vary significantly under aerobic and anaerobic conditions. The biodegradation mechanisms involve complex enzymatic processes mediated by various bacterial species, with degradation rates strongly influenced by environmental parameters including oxygen availability, temperature, pH, and microbial community structure.

Aerobic Biodegradation Pathways

Under aerobic conditions, triclosan biodegradation proceeds through multiple enzymatic pathways involving specialized bacterial communities. Studies have demonstrated that aerobic microorganisms can achieve substantial triclosan removal, with degradation efficiencies ranging from 62% to 95% depending on environmental conditions and microbial populations [1] [2]. The aerobic degradation process typically follows first-order kinetics, with rate constants varying from 0.0072 h⁻¹ in activated sludge systems to 0.0081 s⁻¹ under optimized conditions [3] [4].

The primary aerobic degradation pathway involves initial hydroxylation and dechlorination reactions catalyzed by monooxygenase enzymes. Sphingopyxis strain KCY1, a specialized triclosan-degrading bacterium isolated from wastewater, demonstrates remarkable degradation capabilities with a maximum specific degradation rate of 0.13 mg-triclosan/mg-protein/day and a half-velocity constant of 2.8 mg-triclosan/L [5]. This strain utilizes a meta-cleavage pathway involving catechol 2,3-dioxygenase, producing five identified metabolites including 2,4-dichlorophenol, catechol, and phenol as intermediate products [6].

Recent genomic analysis of Pseudomonas species W03 revealed a novel degradation pathway involving dechlorination, oxidation, ether bond fission, and reoxidation processes, enabling metabolic degradation of triclosan concentrations up to 10 mg/L [7]. The degradation pathway proceeds through angular dioxygenase-mediated conversion, with TcsAaAb catalyzing the transformation of triclosan to 4-chlorocatechol and 3,5-dichlorocatechol, subsequently catabolized via ortho-cleavage mechanisms [8].

Aerobic enrichment cultures demonstrate rapid triclosan degradation, achieving 95% removal within 5 days at concentrations of 10 mg/L, producing 2,4-dichlorophenol as the primary degradation product [1]. The degradation efficiency in activated sludge systems shows strong correlation with environmental parameters, with optimal conditions at 30°C and pH 7.0, though substantial activity persists at pH 4.0 [7].

Anaerobic Biodegradation Mechanisms

Anaerobic biodegradation of triclosan proceeds through markedly different mechanisms compared to aerobic processes, generally exhibiting significantly reduced degradation rates and altered metabolic pathways. Under anaerobic conditions, triclosan demonstrates substantial persistence, with studies showing minimal degradation over 70-day experimental periods in soil systems [9] [10].

The anaerobic degradation pathway involves reductive dechlorination mechanisms mediated by metal-reducing bacteria such as Shewanella putrefaciens CN32 [11]. This process requires specific environmental conditions, including elevated pH levels (pH 9) and the presence of electron shuttles provided by natural organic matter. The degradation efficiency demonstrates a dual dependence on organic matter concentration, with enhancement at low concentrations (0-15 mg C/L) and inhibition at higher concentrations (15-100 mg C/L) [11].

Anaerobic sludge digestion processes show variable triclosan removal efficiencies, typically achieving 23-56% degradation depending on digestion conditions and sludge characteristics [12]. The anaerobic environment favors formation of persistent metabolites, particularly methyl-triclosan, with transformation rates of 37-74% observed during anaerobic digestion processes [13].

Microbial Community Structure and Function

The degradation of triclosan involves complex microbial communities with specialized metabolic capabilities. Microbial fuel cell studies have identified 32 dominant bacterial species involved in triclosan biodegradation, including Sulfuricurvum kujiense, Halomonas phosphatis, Proteiniphilum acetatigens, and Azoarcus indigens, which contribute to dihydroxylation, ring cleavage, and dechlorination processes [14].

The biodegradation mechanisms include six primary biochemical reactions: decarboxylation, dehalogenation, dioxygenation, hydrolysis, hydroxylation, and ring-cleavage, each catalyzed by specific enzymatic systems within the microbial community [2] [15]. The relative contribution of each mechanism varies with environmental conditions and microbial community composition.

Photodegradation Products and Reaction Kinetics

Photodegradation represents a critical transformation pathway for triclosan in surface waters, proceeding through both direct and indirect photolytic mechanisms that generate various photoproducts of environmental concern. The photodegradation kinetics and product formation patterns are strongly influenced by light wavelength, intensity, water chemistry, and environmental matrices.

Direct Photolysis Mechanisms

Direct photolysis of triclosan occurs readily under natural sunlight conditions, with half-lives typically less than 5 hours in surface waters at pH 8 under noon summer sunlight at 45°N latitude [16]. The photodegradation follows pseudo-first-order kinetics, with rate constants ranging from 0.0392 s⁻¹ under UV radiation to variable rates depending on light intensity and water chemistry [17].

The efficiency of direct photolysis is strongly pH-dependent due to the ionization state of triclosan. At environmentally relevant pH values, approximately 28% of triclosan exists in the deprotonated form, which exhibits photodegradation rates approximately 14 times faster than the protonated species [18]. This pH dependence results in seasonal variations in photodegradation rates, with lower concentrations observed during summer months when photodegradation is most efficient [19].

Wavelength-specific studies demonstrate varying degradation efficiencies across the UV spectrum. UV-C radiation (254 nm) achieves 90-98% triclosan degradation efficiency, while UV-A radiation (365 nm) shows reduced efficiency of 79-90% [20] [21]. The photodegradation rate increases proportionally with UV intensity, following pseudo-first-order kinetics at all tested intensities [20].

Photoproduct Formation and Toxicity

The photodegradation of triclosan generates multiple transformation products, many of which exhibit enhanced environmental persistence and toxicity compared to the parent compound. The primary photoproducts include 2,8-dichlorodibenzo-p-dioxin (2,8-DCDD) and 2,4-dichlorophenol (2,4-DCP), with yields ranging from 3-12% depending on experimental conditions [16] [22].

Under UV-C irradiation, two major products are formed through reductive dechlorination and nucleophilic substitution reactions, with molecular masses of 235 and 252 Da [23]. UV-A irradiation generates three dioxin-like isomer products through dechlorination, cyclization, and hydroxylation pathways, which demonstrate significantly higher microtoxicity and genotoxicity compared to the parent compound [23].

Photodegradation on mineral surfaces, particularly kaolinite, exhibits enhanced dioxin formation compared to aqueous solutions. Molecular dynamic modeling reveals that triclosan binds to kaolinite surfaces through hydrogen bonds involving the phenol function, creating specific conformations that promote dimer-type photoproduct formation through π-stacking interactions [24] [25].

Environmental Photodegradation Kinetics

Field studies in natural water systems demonstrate rapid triclosan photodegradation in lake epilimnions, with removal rates of 0.03/day attributed to photochemical processes [19]. Laboratory experiments using natural lake water show complete degradation within one hour during summer conditions for the dissociated form of triclosan [19].

The presence of dissolved organic matter significantly influences photodegradation kinetics through both enhancement and inhibition mechanisms. Natural organic matter can act as photosensitizer, promoting indirect photolysis through reactive oxygen species generation, while simultaneously providing protection through light screening effects [26].

Comparative studies using UV-C and simulated solar irradiation reveal optimal degradation conditions at residence times of 4 hours and irradiance levels of 450 W m⁻² [27]. The formation of quinone and hydroquinone as primary byproducts indicates multiple transformation pathways operating simultaneously under different irradiation conditions [27] [28].

Sorption Dynamics in Sediment-Water Systems

The sorption behavior of triclosan in sediment-water systems governs its distribution, bioavailability, and ultimate environmental fate. Sorption processes significantly influence triclosan persistence and transformation rates, with distribution coefficients varying widely depending on sediment characteristics and environmental conditions.

Sorption Isotherms and Distribution Coefficients

Triclosan exhibits strong affinity for sediment matrices, with sediment-water distribution coefficients (Kd) ranging from 203 to 1572 L/kg in freshwater systems [29]. Batch equilibrium studies demonstrate that sorption behavior follows both linear and Freundlich isotherm models, depending on concentration ranges and sediment characteristics [30].

At higher triclosan concentrations (50-250 μg/g), S-shaped sorption isotherms indicate complex binding mechanisms involving both specific and non-specific interactions [30]. Linear sorption models provide adequate descriptions at lower concentration ranges (10-150 μg/g), with distribution coefficients strongly correlated to total organic carbon content of sediments [31] [32].

Field studies in estuarine systems report higher distribution coefficients, with average values of approximately 9000 L/kg for suspended matter in the Hudson River Estuary [33]. This elevated partitioning reflects the combined influence of salinity, organic matter content, and particle size distribution in marine environments [34].

Organic Carbon Normalization and Binding Mechanisms

Normalized organic carbon-water partition coefficients (log KOC) for triclosan range from 3.90 to 5.26, significantly higher than values obtained using standard OECD 121 methods (2.62-2.92) [29]. Field-derived KOC values show excellent agreement with laboratory measurements, with average log KOC values of 4.54 reported from extensive field studies in urban catchments [29].

The sorption capacity demonstrates strong correlation with total organic carbon content across diverse sediment types. Sediments with higher organic carbon content and lower pH values exhibit greatest adsorption capabilities, with the Pearl River sediment showing exceptional triclosan capture capacity due to its large cumulative pore volume [30].

Molecular-level investigations reveal that triclosan binding involves both hydrophobic partitioning into organic matter and specific interactions with mineral surfaces. The relatively non-polar character of triclosan (log KOW = 4.76) promotes accumulation in organic carbon-rich matrices, while hydrogen bonding interactions contribute to binding strength [35].

Environmental Factors Affecting Sorption

Multiple environmental factors influence triclosan sorption dynamics in sediment-water systems. pH effects are particularly pronounced, with sorption decreasing significantly as pH increases from 4 to 8 due to deprotonation of the phenolic hydroxyl group [36]. This pH dependence has important implications for seasonal and diurnal variations in triclosan distribution.

The presence of biosurfactants, such as rhamnolipid, markedly decreases sediment-water distribution ratios through micelle formation and solubilization effects [30]. Competition from other organic contaminants can also influence sorption behavior, with concentration-dependent effects observed when triclosan coexists with structurally similar compounds [36].

Temperature effects on sorption equilibria show complex patterns, with both kinetic and thermodynamic factors contributing to observed variations. Sediment characteristics including clay mineral content, pore size distribution, and aging effects influence long-term sorption behavior and desorption kinetics [31].

Formation of Persistent Metabolites (e.g., Methyl Triclosan)

The formation of methyl-triclosan represents a critical aspect of triclosan environmental fate, as this metabolite exhibits enhanced persistence and bioaccumulation potential compared to the parent compound. Methylation occurs through biological processes in various environmental compartments, generating a persistent contaminant that accumulates in aquatic organisms and sediments.

Methylation Mechanisms and Pathways

Methyl-triclosan formation occurs primarily through biological O-methylation processes mediated by environmental microorganisms. The methylation reaction involves attachment of a methyl group to the hydroxyl group on the triclosan molecule, a process known to occur via Rhodococcus, Acinetobacter, and Mycobacterium species in chlorophenolic compounds [37].

Laboratory studies demonstrate continuous methyl-triclosan formation during aerobic activated sludge treatment, with approximately 7.4% of triclosan loss attributed to methylation reactions [12]. The methylation process shows concentration dependence, with formation rates varying according to initial triclosan concentrations and environmental conditions [4] [38].

Wastewater treatment systems facilitate methyl-triclosan formation through biological processes, with conversion rates typically ranging from 1-2% of total triclosan input [37] [39]. However, methylation continues post-treatment in receiving environments, leading to gradual accumulation of this persistent metabolite in aquatic systems [37].

Environmental Distribution and Persistence

Methyl-triclosan demonstrates significantly enhanced environmental persistence compared to triclosan, with resistance to both photodegradation and biodegradation processes. While triclosan undergoes rapid photodegradation in surface waters (half-life <1 hour in summer), methyl-triclosan remains relatively stable under similar conditions [19].

Field studies in Swiss lakes and rivers detect methyl-triclosan at concentrations up to 2 ng/L, with preferential accumulation in passive sampling devices compared to the parent compound [19]. The environmental persistence of methyl-triclosan results in seasonal concentration patterns, with relative concentrations increasing from 2% of emissions to 30% of triclosan concentrations in lake epilimnion during summer months [19].

Bioaccumulation studies demonstrate that methyl-triclosan accumulates preferentially in aquatic organisms, with bioconcentration factors comparable to persistent chlorinated organic pollutants [19]. Fish tissue analyses reveal significant methyl-triclosan burdens, with highest concentrations detected in organisms from rivers receiving wastewater discharge [39].

Treatment System Behavior and Control

Methyl-triclosan behavior in wastewater treatment systems differs markedly from the parent compound, with enhanced resistance to conventional treatment processes. Anaerobic digestion shows variable effectiveness for methyl-triclosan transformation, with removal efficiencies of 37-74% observed under optimized conditions [13].

The distribution of methyl-triclosan between aqueous and solid phases in treatment systems depends on organic carbon content and system operating conditions. Advanced treatment processes including sludge heat treatment and dewatering show limited effectiveness for methyl-triclosan removal, contributing to its discharge in treated effluents [13].

Monitoring studies across multiple wastewater treatment plants reveal widespread methyl-triclosan occurrence in both raw and treated sewage sludge, with mass ratios serving as indicators of transformation activity [13]. The persistence of methyl-triclosan in biosolids has important implications for land application practices and long-term environmental contamination [40].

Bioaccumulation and Ecological Implications

The enhanced lipophilicity of methyl-triclosan compared to triclosan results in increased bioaccumulation potential and prolonged residence times in biological tissues. Studies with grass shrimp demonstrate methyl-triclosan accumulation following exposure to triclosan, indicating in vivo formation and retention of this metabolite [41].

Biotransformation studies in fish reveal slow O-demethylation of methyl-triclosan back to triclosan, with calculated rates of 0.10 pmol/min/mg protein at environmentally relevant concentrations [42]. This slow metabolic conversion suggests that methyl-triclosan may bioaccumulate in exposed fish, potentially transferring up the food chain [42].

Purity

Physical Description

Color/Form

XLogP3

Hydrogen Bond Acceptor Count

Hydrogen Bond Donor Count

Exact Mass

Monoisotopic Mass

Boiling Point

Heavy Atom Count

LogP

log Kow = 4.76

Odor

Appearance

Melting Point

54-57.3 °C

Storage

UNII

GHS Hazard Statements

H319: Causes serious eye irritation [Warning Serious eye damage/eye irritation];

H400: Very toxic to aquatic life [Warning Hazardous to the aquatic environment, acute hazard];

H410: Very toxic to aquatic life with long lasting effects [Warning Hazardous to the aquatic environment, long-term hazard]

Use and Manufacturing

Drug Indication

Therapeutic Uses

/CLINICAL TRIALS/ ClinicalTrials.gov is a registry and results database of publicly and privately supported clinical studies of human participants conducted around the world. The Web site is maintained by the National Library of Medicine (NLM) and the National Institutes of Health (NIH). Each ClinicalTrials.gov record presents summary information about a study protocol and includes the following: Disease or condition; Intervention (for example, the medical product, behavior, or procedure being studied); Title, description, and design of the study; Requirements for participation (eligibility criteria); Locations where the study is being conducted; Contact information for the study locations; and Links to relevant information on other health Web sites, such as NLM's MedlinePlus for patient health information and PubMed for citations and abstracts for scholarly articles in the field of medicine. Triclosan is included in the database.

Control of meticillin-resistant Staphylococcus aureus (MRSA) infection in surgical units has been achieved by procedures including handwashing and bathing with triclosan.

Triclosan is a chlorinated bisphenol antiseptic, effective against Gram-positive and most Gram-negative bacteria but with variable or poor activity against Pseudomonas spp. It is also active against fungi. It is used in soaps, creams, and solutions in concentration of up to 2% for disinfection of the hands and wounds and for disinfection of the skin prior to surgery, injections, or venepuncture. It is also used in oral hygiene products and in preparations for acne.

For more Therapeutic Uses (Complete) data for Triclosan (7 total), please visit the HSDB record page.

Pharmacology

MeSH Pharmacological Classification

ATC Code

D08 - Antiseptics and disinfectants

D08A - Antiseptics and disinfectants

D08AE - Phenol and derivatives

D08AE04 - Triclosan

D - Dermatologicals

D09 - Medicated dressings

D09A - Medicated dressings

D09AA - Medicated dressings with antiinfectives

D09AA06 - Triclosan

Mechanism of Action

Triclosan (TCS) exposure has widely adverse biological effects such as influencing biological reproduction and endocrine disorders. While some studies have addressed TCS-induced expression changes of miRNAs and their related down-stream target genes, no data are available concerning how TCS impairs miRNA expression leading us to study up-stream regulating mechanisms. Four miRNAs (miR-125b, miR-205, miR-142a and miR-203a) showed differential expression between TCS-exposure treatments and the control group; their functions mainly involved fatty acid synthesis and metabolism. TCS exposure led to the up-regulation of mature miR-125b that was concomitant with consistent changes in pri-mir-125b-1 and pri-mir-125b-3 among its 3 pri-mir-125bs. Up-regulation of miR-125b originated from direct shear processes involving the two up-regulated precursors, but not pri-mir-125b2. Increased expression of pri-mir-125b-1 and pri-mir-125b-3 resulted from nfe2l2- and c/ebpa-integration with positive control elements of promoters for the two precursors. The overexpression of transcriptional factors, nfe2l2 and c/ebpa, initiated the promoter activity for the miR-125b precursor. CpG islands and Nfe2l2 were involved in constitutive expression of mir-125b-1 and mir-125b-3. The activities of two promoter regions, -487 to -1bp for pri-mir-125b1 and -1327 to +14bp for pri-mir-125b-3 having binding sites for NFE2 and Nfe2l2/MAF:NFE2, were higher than other regions, further demonstrating that the transcriptional factor Nfe2l2 was involved in the regulation of pri-mir-125b1 and pri-mir-125b-3. TCS's estrogen activity resulted from its effects on GPER, a novel membrane receptor, rather than the classical ERa and ERbeta. These results explain, to some extent, the up-stream mechanism for miR-125b up-regulation, and also provide a guidance to future mechanistic study on TCS-exposure.

Vapor Pressure

Pictograms

Irritant;Environmental Hazard

Other CAS

Absorption Distribution and Excretion

In one study, after in vivo topical application of a 64.5mM alcoholic solution of [(3)H]triclosan to rat skin, 12% radioactivity was recovered in the faeces, 8% in the carcass 1% in the urine, 30% in the stratum corneum and 26% was rinsed from the skin surface at 24 hours after application.

The number of personal hygiene products containing triclosan has increased rapidly during the last decade, and triclosan is one of the most common antibacterial compounds used in dentifrices today. However, the extent of triclosan exposure has not yet been well described. The potential risks of generating triclosan-resistant pathogenic microorganisms or of the selection of resistant strains are some areas of concern. The aim of the present study was to (1) obtain information on baseline levels of triclosan in plasma and urine, and (2) study the pharmacokinetic pattern of triclosan after a single-dose intake. Ten healthy volunteers were exposed to a single oral dose of 4 mg triclosan by swallowing an oral mouthwash solution. Triclosan in plasma and urine was followed before and up to 8 days after exposure. Triclosan levels in plasma increased rapidly, with a maximum concentration within 1 to 3 hr, and the terminal plasma half-life was 21 hr. The major fraction was excreted within the first 24 hr. The accumulated urinary excretion varied between the subjects, with 24 to 83% of the oral dose being excreted during the first 4 d after exposure. In conclusion, triclosan appears to be readily absorbed from the gastrointestinal tract and has a rapid turnover in humans. The high lipid solubility of the substance gives rise to questions regarding distribution properties and accumulation. The findings of the present study form a basis for greater understanding of the toxicokinetic properties of triclosan in humans.

/MILK/ Triclosan amounts in breast milk were reported to range from <20 to 300 ug/kg lipid in one study and <5 to 2100 ug/kg lipid in another. In a study that compared triclosan levels in women who used triclosan-containing products with those who did not, levels in breast milk were 0.022 to 0.95 ug/kg lipid compared to 0.018 to 0.35 ug/kg lipid, respectively.

Oral and dermal routes (humans and rodents): Triclosan glucuronide is predominantly excreted in the urine, and triclosan is predominantly excreted in the feces. Triclosan that is administered orally and dermally is excreted in greater concentrations in the urine than in the feces in humans, hamsters, rabbits, and monkey. In rats, mice, and dog, the reverse is true. Up to 87% of triclosan that is administered to humans (by an unspecified route) is excreted in the urine, most of it within 72 hr after dose.

The percutaneous absorption of unlabeled triclosan was investigated in a pilot study and a 90-day study with infant Rhesus monkeys. In the pilot study, triclosan was detected in all blood samples following a single dermal exposure to a soap solution containing triclosan (1 mg/mL, 0.1%), with blood levels detected up to 24 hours, and peak levels observed at 8 to 12 hours. In the 90-day study, only the glucuronide and sulfate conjugates were detected in blood samples, the glucuronide predominating in the early blood samples (Days 1 to 2), and triclosan sulfate predominating in all subsequent blood samples (samples were taken daily for the 90-day duration of the study). Triclosan was excreted in the urine primarily as the glucuronide conjugate, but was excreted in the feces primarily in the free or unconjugated form. Low levels of triclosan were detected in tissues. The results of this monkey study indicate that triclosan was absorbed percutaneously following 90 days of daily washing with 15 mL of soap (1 mg triclosan/mL) and that the proportion of plasma glucuronide and sulfate conjugates altered following chronic administration.

For more Absorption, Distribution and Excretion (Complete) data for Triclosan (14 total), please visit the HSDB record page.

Metabolism Metabolites

Oral and dermal routes (humans and rodents): Triclosan absorbed from the gastrointestinal tract undergoes extensive first-pass metabolism, which primarily involves glucuronide and sulfate conjugation. In both humans and rodents, at high triclosan plasma concentrations, metabolism shifts from the generation of predominantly glucuronide conjugates to sulfate-conjugates. The bioavailability of unconjugated triclosan may be limited after oral exposure because of triclosan's extensive first-pass metabolism. Triclosan is also metabolized to its glucuronide and sulfate conjugates by the skin.

Triclosan has been widely used as a disinfectant in human health care products. Although this particular chemical is less toxic, its biotransformation products might have toxicity to human. Therefore, understanding the pharmacokinetics and metabolism of triclosan in animal and human body is important. Plasma samples from SD rats collected after the oral administration of 5 mg/kg triclosan were analyzed ... . The pharmacokinetic data of triclosan in the rats were presented including the half time of elimination that was (48.5 +/- 10.5) hr, indicating that the elimination of triclosan in the rat was slow. Two hydroxylated and sulfonated triclosan, one glucuronidated triclosan, and one sulfonated triclosan were identified in the rat plasma samples.

...Irgasan DP 300 is excreted unchanged in feces and urine (partly conjugated) but is also hydroxylated to five different monohydroxy metabolites which were found in urine; three of these were also present in feces.

Triclosan has known human metabolites that include Triclosan sulfate and (2S,3S,4S,5R)-6-[5-chloro-2-(2,4-dichlorophenoxy)phenoxy]-3,4,5-trihydroxyoxane-2-carboxylic acid.

Triclosan is prone to phase II metabolism via sulfotransferase and glucuronosyltransferase enzymes (Wang et al., 2004). In humans the resulting conjugates are excreted primarily in urine (Sandborgh-Englund et al., 2006). In one study, after in vivo topical application of a 64.5mM alcoholic solution of [(3)H]triclosan to rat skin, 12% radioactivity was recovered in the faeces, 8% in the carcass 1% in the urine, 30% in the stratum corneum and 26% was rinsed from the skin surface at 24 hours after application. (A7866) The terminal plasma half life of triclosan is 21 h (Sandborgh-Englund et al., 2006).

Wikipedia

Amlodipine

Biological Half Life

Measurements of the oral retention and pharmacokinetics of (3)H-triclosan delivered from a toothpaste containing 0.2% (3)H-triclosan were made in 12 human volunteers (aged 19-37 yr). ... After use of a one g quantity of the toothpaste, 36.3+-1.4% of the (3)H-triclosan was retained. ... The saliva decay curve for (3)H-triclosan was consistent with a 2 phase model with half life values of 0.45 hr and 2.42 hr, respectively. ...

... Ten healthy volunteers were exposed to a single oral dose of 4 mg triclosan by swallowing an oral mouthwash solution. Triclosan in plasma and urine was followed before and up to 8 days after exposure. Triclosan levels in plasma increased rapidly, with a maximum concentration within 1 to 3 hr, and the terminal plasma half-life was 21 hr. ...

The blood half-life of (14)C-triclosan during the beta-phase was 8.8 +/- 0.6 hr and the blood clearance rate was 77.5 +/- 11.3 mL/kg/hr /after injection either via the femoral vein, (iv, 5 mg/kg in polyethylene glycol-400) or into the vaginal orifice (ivg, 5 mg/kg in corn oil)/ .

Plasma samples from SD rats collected after the oral administration of 5 mg/kg triclosan were analyzed ... . The pharmacokinetic data of triclosan in the rats were presented including the half time of elimination that was (48.5 +/- 10.5) hr, indicating that the elimination of triclosan in the rat was slow. Two hydroxylated and sulfonated triclosan, one glucuronidated triclosan, and one sulfonated triclosan were identified in the rat plasma samples.

Use Classification

Cosmetics -> Preservative

INDUSTRIAL

Methods of Manufacturing

General Manufacturing Information

Phenol, 5-chloro-2-(2,4-dichlorophenoxy)-: ACTIVE

Analytic Laboratory Methods

Method: Abraxis 530114; Procedure: immunoassay, microtiter plate; Analyte: triclosan; Matrix: water (groundwater, surface water, well water); Detection Limit: 0.02 ng/mL.

Method: EPA-OW/OST 1694; Procedure: high performance liquid chromatography combined with tandem mass spectrometry; Analyte: triclosan; Matrix: water, soil, sediment, and biosolids; Detection Limit: 92 ng/L.

Method: USGS-NWQL O-1433-01; Procedure: gas chromatography/mass spectrometry; Analyte: triclosan; Matrix: filtered wastewater and natural-water samples; Detection Limit: 0.48 ug/L.

For more Analytic Laboratory Methods (Complete) data for Triclosan (8 total), please visit the HSDB record page.

Storage Conditions

Interactions

Atrazine is an herbicide with several known toxicologically relevant effects, including interactions with other chemicals. Atrazine increases the toxicity of several organophosphates and has been shown to reduce the toxicity of triclosan to Daphnia magna in a concentration dependent manner. Atrazine is a potent activator in vitro of the xenobiotic-sensing nuclear receptor, HR96, related to vertebrate constitutive androstane receptor (CAR) and pregnane X-receptor (PXR). RNA sequencing (RNAseq) was performed to determine if atrazine is inducing phase I-III detoxification enzymes in vivo, and estimate its potential for mixture interactions. RNAseq analysis demonstrates induction of glutathione S-transferases (GSTs), cytochrome P450s (CYPs), glucosyltransferases (UDPGTs), and xenobiotic transporters, of which several are verified by qPCR. Pathway analysis demonstrates changes in drug, glutathione, and sphingolipid metabolism, indicative of HR96 activation. Based on our RNAseq data, we hypothesized as to which environmentally relevant chemicals may show altered toxicity with co-exposure to atrazine. Acute toxicity tests were performed to determine individual LC50 and Hillslope values as were toxicity tests with binary mixtures containing atrazine. The observed mixture toxicity was compared with modeled mixture toxicity using the Computational Approach to the Toxicity Assessment of Mixtures (CATAM) to assess whether atrazine is exerting antagonism, additivity, or synergistic toxicity in accordance with our hypothesis. Atrazine-triclosan mixtures showed decreased toxicity as expected; atrazine-parathion, atrazine-endosulfan, and to a lesser extent atrazine-p-nonylphenol mixtures showed increased toxicity. In summary, exposure to atrazine activates HR96, and induces phase I-III detoxification genes that are likely responsible for mixture interactions.

... The aim of the present study was to examine whether triclosan reduces the clinical symptoms on skin after exposure to nickel in an allergic patch test reaction (APR) model. 1% nickel sulfate was used for APR in 10 nickel-allergic females. The results showed that application of triclosan on skin reduced the APR symptoms from nickel in sensitized patients significantly (p<0.05) compared to the saline and alcohol solutions.

... The aim of the present study was to examine whether triclosan has an effect on the inflammation in human skin caused by intradermal administration of histamine. 9 female volunteers participated in a double-blind study, and skin patch tests were performed in 2 series. In the 1st, the skin was pre-treated for 1 hr with triclosan before the histamine was applied. In the 2nd, the histamine reaction was elicited first and triclosan applied subsequently. The effect of triclosan on the wheals formed in the skin after histamine application was measured. It was found that triclosan reduced the size of the wheals markedly when triclosan was applied after the wheals were formed, and that pre-treatment of the skin had only a slight effect.

... The effects of triclosan /were evaulated/ in the female Wistar rat following exposure for 21 days in the Endocrine Disruptor Screening Program pubertal protocol and the weanling uterotrophic assay (3-day exposure). In the pubertal study, triclosan advanced the age of onset of vaginal opening and increased uterine weight at 150 mg/kg, indicative of an estrogenic effect. In the uterotrophic assay, rats received oral doses of triclosan (1.18, 2.35, 4.69, 9.37, 18.75, 37.5, 75, 150, and 300 mg/kg) alone, 3 ug/kg ethinyl estradiol (EE), or triclosan (same doses as above) plus 3 ug/kg EE. Uterine weight was increased in the EE group (positive control) as compared with the control but was not affected by triclosan alone. However, there was a significant dose-dependent increase in the group cotreated with EE and triclosan (> or = 4.69 mg/kg) as compared with EE alone, indicating a potentiation of the estrogen response on uterine weight. This result was well correlated with potentiated estrogen-induced changes in uterine histology. Serum thyroid hormone concentrations were also suppressed by triclosan in this study, similar to other studies in the male and female rat. In conclusion, triclosan affected estrogen-mediated responses in the pubertal and weanling female rat and also suppressed thyroid hormone in both studies. The lowest effective concentrations in the rodent model are approximately 10 (for estrogen) and 40 (for thyroid hormone) times higher than the highest concentrations reported in human plasma.

Stability Shelf Life

Dates

Biomarkers-based assessment of triclosan toxicity in aquatic environment: A mechanistic review

Saurav Kumar, Tapas Paul, S P Shukla, Kundan Kumar, Sutanu Karmakar, Kuntal Krishna Bera, Chandra Bhushan KumarPMID: 34438492 DOI: 10.1016/j.envpol.2021.117569

Abstract

Triclosan (TCS), an emergent pollutant, is raising a global concern due to its toxic effects on organisms and aquatic ecosystems. The non-availability of proven treatment technologies for TCS remediation is the central issue stressing thorough research on understanding the underlying mechanisms of toxicity and assessing vital biomarkers in the aquatic organism for practical monitoring purposes. Given the unprecedented circumstances during COVID 19 pandemic, a several-fold higher discharge of TCS in the aquatic ecosystems cannot be considered a remote possibility. Therefore, identifying potential biomarkers for assessing chronic effects of TCS are prerequisites for addressing the issues related to its ecological impact and its monitoring in the future. It is the first holistic review on highlighting the biomarkers of TCS toxicity based on a comprehensive review of available literature about the biomarkers related to cytotoxicity, genotoxicity, hematological, alterations of gene expression, and metabolic profiling. This review establishes that biomarkers at the subcellular level such as oxidative stress, lipid peroxidation, neurotoxicity, and metabolic enzymes can be used to evaluate the cytotoxic effect of TCS in future investigations. Micronuclei frequency and % DNA damage proved to be reliable biomarkers for genotoxic effects of TCS in fishes and other aquatic organisms. Alteration of gene expression and metabolic profiling in different organs provides a better insight into mechanisms underlying the biocide's toxicity. In the concluding part of the review, the present status of knowledge about mechanisms of antimicrobial resistance of TCS and its relevance in understanding the toxicity is also discussed referring to the relevant reports on microorganisms.Triclosan weakens the nitrification process of activated sludge and increases the risk of the spread of antibiotic resistance genes

Qiyang Tan, Jinmei Chen, Yifan Chu, Wei Liu, Lingli Yang, Lin Ma, Yi Zhang, Dongru Qiu, Zhenbin Wu, Feng HePMID: 34492900 DOI: 10.1016/j.jhazmat.2021.126085

Abstract

The usage of triclosan (TCS) may rise rapidly due to the COVID-19 pandemic. TCS usually sinks in the activated sludge. However, the effects of TCS in activated sludge remain largely unknown. The changes in nitrogen cycles and the abundances of antibiotic resistance genes (ARGs) caused by TCS were investigated in this study. The addition of 1000 μg/L TCS significantly inhibited nitrification since the ammonia conversion rate and the abundance of nitrification functional genes decreased by 12.14%. The other nitrogen cycle genes involved in nitrogen fixation and denitrification were also suppressed. The microbial community shifted towards tolerance and degradation of phenols. The addition of 100 μg/L TCS remarkably increased the total abundance of ARGs and mobile genetic elements by 33.1%, and notably, the tetracycline and multidrug resistance genes increased by 54.75% and 103.42%, respectively. The co-occurrence network revealed that Flavobacterium might have played a key role in the spread of ARGs. The abundance of this genus increased 92-fold under the addition of 1000 μg/L TCS, indicating that Flavobacterium is potent in the tolerance and degradation of TCS. This work would help to better understand the effects of TCS in activated sludge and provide comprehensive insight into TCS management during the pandemic era.Polymer-based immobilized Fe

Sarath Chandra Pragada, Arun Kumar ThallaPMID: 34328863 DOI: 10.1016/j.jenvman.2021.113305

Abstract

The present study involves a novel protocol to develop a ternary composite catalyst for an effective post-treatment technique for greywater. The ternary film of FeO

-TiO

/polyvinyl pyrrolidine (PVP) is coated on a glass tube using spray coating with annealing at 320 °C. The structure, thermal, microstructure, and surface properties of the coated film are characterized by X-ray diffraction (XRD), Fourier Transform Infrared Spectroscopy (FTIR), Field Emission Scanning Electron Microscopy (FESEM), and Thermo Gravimetric Analysis (TGA). The scratch hardness of photocatalysts at different Fe

O

/TiO

compositions is investigated based on the width measurement of scratch using FESEM analysis. Results show that at an optimum coating of 5% of Fe

O

/TiO

composition catalytic film, the maximum scratch hardness (7.984 GPa) is obtained. Also, the photocatalyst has the highest cohesive bond strength and wearing resistance. The degradation of triclosan (TCS) in treated greywater, discharged from the anaerobic-aerobic treatment system, is investigated at a lab-scale using a solar photocatalytic reactor. The response surface analysis has been performed from the different sets of experimental trials for various optimal parameters. It is observed that the TCS degradation efficiency of 83.27% has resulted under optimum conditions.

Kyung Sik Yoon, Seung Jun Kwack

PMID: 34193021 DOI: 10.1080/15287394.2021.1944940

Abstract

Triclosan (TCS) is an antibacterial and antifungal agent used in many consumer products and exhibits a chemical structure similar to non-steroidal estrogen, which is known to induce endocrine disruption. Triclosan has been found in human plasma, urine, and breast milk, and the safety of TCS-containing products has been disputed. Although studies attempted to determine the estrogenic activity of TCS, no clear results have emerged. The aim of the present study was to examine estrogenic activity of TCS using anE-screen assay and an

uterotrophic assay. The

E-screen assay demonstrated that TCS significantly enhanced proliferation of MCF-7 breast cancer cells, although not in a concentration-dependent manner. The

uterotrophic results showed no significant change in the weight of uteri obtained from TCS-administered Sprague-Dawley rats. Further, to understand the estrogenic activity attributed to TCS at the molecular level, gene-expression profiling of uterus samples was performed from both TCS- or estrogen-treated rats and the genes and cellular processes affected by TCS or estrogen were compared. Data demonstrated that both the genes and cellular processes affected by TCS or estrogen were significantly similar, indicating the possibility that TCS-mediated estrogenic activity occurred at the global transcriptome level. In conclusion,

and gene-profiling results suggested that TCS exhibited estrogenic activity.

Triclosan regulates the Nrf2/HO-1 pathway through the PI3K/Akt/JNK signaling cascade to induce oxidative damage in neurons

Dan Wang, Jieyu Liu, Hong JiangPMID: 34160118 DOI: 10.1002/tox.23315

Abstract

Triclosan (TCS), a broad-spectrum antimicrobial agent, is recognized as an environmental endocrine disruptor. TCS has caused a wide range of environmental, water and soil pollution. TCS is also still detected in food. Due to its high lipophilicity and stability, TCS can enter the human body through biological enrichment and potentially threatenes human health. In recent years, the neurotoxic effects caused by TCS contamination have attracted increasing attention. This study was designed to investigate the mechanism underlying TCS-induced HT-22 cells injury and to explore the effect of TCS on the PI3K/Akt, MAPK, and Nrf2/HO-1 signaling pathways in HT-22 cells. In this study, we examined the adverse effects of TCS treatment on ROS generation, and MDA, GSH-Px, and SOD activities. The expression levels of proteins in the Nrf2, PI3K/Akt, MAPK pathways and Caspase-3, BAX, Bcl-2 were measured and quantified by Western blotting. The results showed that TCS could significantly reduce the activity of HT-22 cells, increase the production of intracellular ROS and upregulate the expression of proapoptotic proteins. In addition, TCS promoted an increase in the MDA and SOD levels, and downregulated the GSH-Px activity, and oxidative damage occurred in neurons. The mechanism underlying this toxicity was related to TCS-induced PI3K/Akt/JNK-mediated regulation of the Nrf2/HO-1 signaling pathway. This result was further confirmed by the specific inhibitors LY294002 and SP600125. In summary, TCS could induce oxidative damage in HT-22 neurons, and activation of the PI3K/Akt/JNK/ Nrf2 /HO-1 signaling cascade was the main mechanism underlying the TCS-induced HT-22 neuronal toxicity.Effectiveness of Triclosan Coated Suture for Subcutaneous Wound Closure in Preventing Surgical Site Infection following Mesh Repair of Inguinal Hernia: A Pilot Study

O Olasehinde, A Aderounmu, A C Etonyeaku, A O Mosanya, F O Wuraola, E A AgbakwuruPMID: 34180209 DOI:

Abstract

The role of prophylactic antibiotics in mesh repair of inguinal hernia is controversial and often based on institutional policies. Surgical site infection rate from earlier studies in Nigeria justifies the continued use of prophylactic antibiotics during hernia repair. With increased use of antibiotics comes the challenge of antibiotic resistance and toxicity. The use of antimicrobial coated suture may help avoid these challenges but its efficacy needs to be tested.To compare Triclosan coated suture with intravenous antibiotics for the repair of inguinal hernia with mesh.

Patients with uncomplicated inguinal hernia undergoing mesh repair were randomized to either have intravenous antibiotics administered for prophylaxis or to have wound closure with Triclosan coated Vicryl 2/0 suture. Post operatively, wound infection rates were compared between the two groups. Follow up was for 1 year.

We studied 49 patients with 59 hernias with a mean age of 53 years. Hernias were solitary in 75% of cases, the majority of which were right sided, while 25% were bilateral. There were 25 patients with 32 hernias in the Intravenous antibiotic group (Group A) and 24 patients with 27 hernias in the Triclosan suture group (Group B). Wound grades were similar between the two groups with one patient in the Triclosan group confirmed to have wound infection (4.2%) and none in the Intravenous antibiotics group (p=0.27). Wound infection was of the superficial type which resolved with wound care within 1 month.

Triclosan coated suture may be safely used as an alternative to intravenous antibiotics for the mesh repair of inguinal hernia. Further studies are required to validate this finding.

A Novel Benzoxaborole Is Active against Escherichia coli and Binds to FabI

Soma Mandal, Tanya ParishPMID: 34152809 DOI: 10.1128/AAC.02622-20

Abstract

To combat the looming crisis of antimicrobial-resistant infections, there is an urgent need for novel antimicrobial discovery and drug target identification. The benzoxaborole series was previously identified as an inhibitor of mycobacterial growth. Here, we demonstrate that a benzoxaborole is also active against the Gram-negative bacterium Escherichia coli. We isolated resistant mutants of E. coli and subjected them to whole-genome sequencing. We found mutations in the enoyl acyl carrier protein FabI. Mutations mapped around the active center site located close to the cofactor binding site. This site partially overlaps with the binding pocket of triclosan, a known FabI inhibitor. Similar to triclosan, the physical interaction of the benzoxaborole with FabI was dependent on the cofactor NAD

. Identification of the putative target of this compound in E. coli provides scope for further development and optimization of this series for Gram-negative pathogens.

Urinary triclosan in south China adults and implications for human exposure

Dongfeng Yang, Sifang Kong, Feng Wang, Lap Ah Tse, Zhi Tang, Yang Zhao, Chun Li, Minhui Li, Zihan Li, Shaoyou LuPMID: 34126513 DOI: 10.1016/j.envpol.2021.117561

Abstract

Triclosan (TCS) is widely applied in personal care products (PCPs) as an antimicrobial preservative. Due to its toxicity and potential risk to human health, TCS has attracted mounting concerns in recent years. However, biomonitoring of TCS in large human populations remains limited in China. In this study, 1163 adults in South China were recruited and urinary TCS concentrations were determined. TCS was detected in 99.5% of urine samples, indicating broad exposure in the study population. Urinary concentrations of TCS ranged from below the limit of detection (LOD) to 270 μg/L, with a median value of 3.67 μg/L. Urinary TCS concentrations from individuals were all lower than the Biomonitoring Equivalents reference dose, suggesting relatively low health risk in the participants. TCS concentrations did not differ significantly between sexes or education levels (p > 0.05). Nevertheless, marital status and age were found to be positively influence TCS levels (p < 0.001). After adjustment for body mass index (BMI), age was determined to be positively associated with TCS concentrations (p < 0.05), particularly in the age group from 31 to 51 years old. This study provides a baseline of urinary TCS exposure in South China general adult populations.The triclosan-induced shift from aerobic to anaerobic metabolism link to increased steroidogenesis in human ovarian granulosa cells

Yatao Du, Bin Wang, Zhenzhen Cai, Huihui Zhang, Bo Wang, Wei Liang, Guangdi Zhou, Fengxiu Ouyang, Weiye WangPMID: 34082246 DOI: 10.1016/j.ecoenv.2021.112389

Abstract

Triclosan (TCS) is an endocrine-disrupting chemical (EDC), which is used ubiquitously as an antimicrobial ingredient in healthcare products and causes contamination in the environment such as air, water, and biosolid-amended soil. Exposure to TCS may increase the risk of reproduction diseases and health issues. Several groups, including ours, have proved that TCS increased the biosynthesis of steroid hormones in different types of steroidogenic cells. However, the precise mechanism of toxic action of TCS on increased steroidogenesis at a molecular level remains to be elucidated. In this study, we try to address the mode of action that TCS affects energy metabolism with increased steroidogenesis. We evaluated the adverse effects of TCS on energy metabolism and steroidogenesis in human ovarian granulosa cells. The goal is to elucidate how increased steroidogenesis can occur with a shortage of adenosine triphosphate (ATP) whereas mitochondria-based energy metabolism is impaired. Our results demonstrated TCS increased estradiol and progesterone levels with upregulated steroidogenesis gene expression at concentrations ranging from 0 to 10 µM. Besides, glucose consumption, lactate level, and pyruvate kinase transcription were increased. Interestingly, the lactate level was attenuated with increased steroidogenesis, suggesting that pyruvate fate was shifted away from the formation of lactate towards steroidogenesis. Our study is gathering evidence suggesting a mode of action that TCS changes energy metabolism by predominating glucose flow towards the biosynthesis of steroid hormones. To the best of our knowledge, this is the first report that TCS presents such toxic action in disrupting hormone homeostasis.Effect of Maternal Triclosan Exposure on Neonatal Birth Weight and Children Triclosan Exposure on Children's BMI: A Meta-Analysis

Jiani Liu, Danrong Chen, Yanqiu Huang, Francis Manyori Bigambo, Ting Chen, Xu WangPMID: 34307271 DOI: 10.3389/fpubh.2021.648196

Abstract

Triclosan (TCS) is an environmental chemical with endocrine disrupting effects and can enter the body through the skin or oral mucosa. Human data about the effect of TCS exposure during pregnancy on neonatal birth weight and TCS exposure during childhood on children's growth are scarce.To investigate the association between maternal urinary TCS level and neonatal birth weight, as well as children's urinary TCS level and children's body mass index (BMI).

A systematic literature search was conducted using PubMed, Cochrane Library, and Web of Science. Finally, seven epidemiological articles with 5,006 participants from September 25, 2014 to August 10, 2018 were included in the meta-analysis to identify the relationship between maternal exposure to TCS and neonatal birth weight. On the other hand, three epidemiological articles with 5,213 participants from July 22, 2014 to September 1, 2017 were included in another meta-analysis to identify the relationship between children's exposure to TCS and children's BMI. We used Stata 16.0 to test the heterogeneity among the studies and calculating the combined effect value 95% confidence interval (CI) of the selected corresponding models.

TCS exposure during pregnancy was not significant associated with neonatal birth weight. The results of forest plots were as follows: ES (Estimate) = 0.41 (95% CI: -11.97-12.78). Children's urinary TCS level was also irrelevant associated with children's BMI: ES = 0.03 (95% CI: -0.54-0.60).

This meta-analysis demonstrated that there was no significant association between maternal TCS level and neonatal birth weight, also there has no relationship between children's urinary TCS level and children's BMI.